Principal Investigator Training ~ Module 2

Introduction

This second module in the Principal Investigator training covers the following topics in financial management of sponsored programs:

- Roles & Responsibilities

- Important Concepts

- Principal Investigator Responsibilities

- Order of Precedence

- Cost Transfers

- Subrecipient Monitoring

- Equipment

- Award Closeout

- Sponsored Program Expenditures

- Cost Sharing

Introduction (cont.)

This second module in the Principal Investigator training covers the following topics in financial management of sponsored programs (cont.):

- Effort Reporting

- Travel & Expense Reimbursement

- Direct Costs

- Indirect Costs

- Spending on an Award

- Procurement

- Monitoring Budgets, Review & Reconciliation, & Effort Reporting

- Grant Closeout

Roles & Responsibilities

As the grantee, the University of New Hampshire (UNH) is ultimately responsible for financial management of grants.

This responsibility has been delegated to the Principal Investigator (PI) with assistance from Sponsored Programs Administration (SPA) and Research Integrity Services (RIS).

As stewards of these awards, UNH is required to comply with its policies and procedures and any additional requirements imposed by the sponsor.

Important Concepts

Financial management may include one or all of the following topics:

Principal Investigator Responsibilities

The PI is the primary individual responsible for the preparation, conduct, and administration of a sponsored project. Here are some of a PI's key responsibilities (click on each item).

Order of Precedence

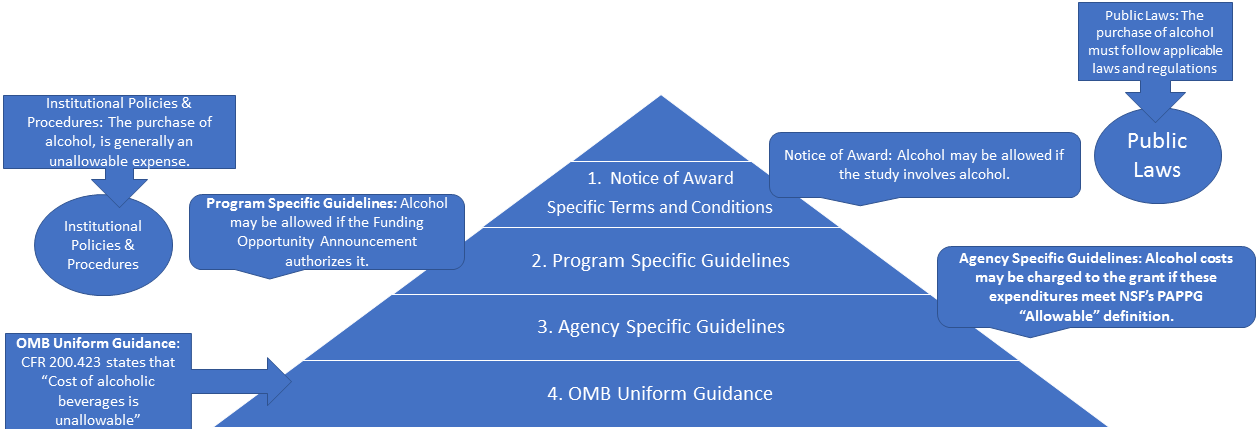

Each award must comply with all applicable rules and regulations, from general (e.g., Uniform Guidance) to more specific (e.g., special terms and conditions in the Notice of Award). University System of New Hampshire (USNH) policies may affect an award. A specific term will take precedence over a general rule, for example, the purchase of alcohol as shown in the example below.

Cost Transfers

A cost transfer is a journal entry that transfers an expense onto a federally-funded sponsored award that was previously recorded

elsewhere on the university's General Ledger (GL) and requires institutional approval before it can be posted to the GL.

UNH's cost transfers policy is available here.

Subrecipient Monitoring

UNH's guidance on Subrecipient Management provides information to:

- Guide PIs and others in the monitoring of subrecipients

- Guide faculty and staff by requiring that subrecipients conduct their portions of research awards in compliance with laws, regulations, and the provisions of awards or sub-awards, and that the project costs incurred by subrecipients are reasonable, allocable and allowable.

Equipment

UNH is responsible for safeguarding, maintaining, disposing of and accounting for capital assets in accordance with Generally Accepted Accounting Principles and in compliance with all applicable laws and regulations, and USNH policy.

USNH's Equipment policy applies to any faculty or staff who purchase, take custody of or dispose of capital assets, and to all capital assets purchased or otherwise transferred to UNH regardless of funding source.

Award Closeout

Closeout of a grant, cooperative agreement or contract is a required element of most sponsored research projects. Upon reaching the project end date, the PI, the SPA-Support Team for the Administration of Research (STAR) and SPA-Accounting and Financial Compliance (AFC) must verify all research activities have been completed and deliverables have been met. Projects should be financially reconciled and inactivated in the system within 90-120 days of the project end date.

Click here to view UNH's Award Closeout procedure.

Sponsored Programs Expenditures

In accepting external financial support for research, training, and other activities, UNH agrees to ensure the sound financial management of the resources provided. A key element to successful management ensures compliance with sponsors' policies and regulations that not only govern what types of costs may be paid with sponsor funds, but also require an appropriate distribution of costs among the various sources which fund the investigator's work. It is important to keep in mind that our sponsors expect adequate financial responsibility in exchange for the resources they provide.

Click to view UNH's Guidance on Expenditures on Sponsored Programs.

Cost Sharing

UNH is committed to supporting the sponsored activities of its faculty and staff but, to ensure that its cost sharing commitments do not overburden its resources, cost sharing should be limited to those situations where it is an eligibility requirement for a proposal submission or when the program description identifies it as a review criterion.

Click to view UNH's Cost Share Policy, and UNH Cost Share Procedures.

Effort Reporting

Effort reporting is the mechanism used to confirm that salaries and wages allocated and charged to projects funded by all external sponsors are reasonable in relation to the actual effort performed on the project.

While salary charges to sponsored projects are made initially based upon the planned or estimated workload of faculty and others, the actual effort of each individual working on sponsored projects must be monitored by the PI with assistance from SPA-STAR, with charges modified as necessary based on variances between the estimated and actual effort.

UNH's Effort Reporting policy is available here.

Travel & Expense Reimbursement

Travelers are expected to exercise good judgment when incurring travel costs, regardless of funding source. Business travel expenses will be paid by

USNH if they are reasonable, properly authorized, appropriately documented with a well-defined, compelling business purpose, and within the guidelines of the policy.

Costs should not be lavish or extravagant, but should be prudent, exercising the fiduciary responsibility entrusted in all USNH employees by the state,

students, governmental and non-government sponsors, donors, and others who provide resources to USNH.

All monies reimbursed will be for the lowest reasonable cost of travel given the circumstances. No portion of costs associated with personal travel will be

paid by USNH. Travelers are responsible for familiarizing themselves and complying with this policy. The USNH Financial Services Office (FSO) is responsible

for oversight of travel policies, procedures, and travel expenditures. The SPA-STAR office determines which travel expenditures are reimbursable

under a grant or contract.

USNH's Travel policy is available here.

Direct Costs

Direct costs are those costs directly attributable to the research project. Allowable direct costs are costs that may be charged to a specific grant, as defined by federal regulations and by the terms of the award; direct costs must meet all these criteria in order to be charged to a specific grant:

- Allocable. Costs must be incurred specifically for the project and proportionate to the relative benefits received by the project.

- Necessary and Reasonable. Goods or services acquired and the amount involved reflect an action that a prudent person would have taken (prudent person rule).

- Treated consistently and conform to the Terms and Conditions of the award. Costs incurred for the same purpose in like circumstances must be treated uniformly as either direct or indirect costs across the university.

Costs that do not meet these principles should not be charged to a sponsored award.

Click to review (OMB) Guidance on Direct Costs and

USNH’s Policy on Supplies Charged to Federally Sponsored Agreements.

Direct Costs (cont.)

Allowable costs must be adequately documented. For more information, review UNH SPA's Expense Approval and Documentation Guidance.

In some cases, expenditures that are normally considered indirect costs

Indirect costs, also known as Overhead or Facilities and Administrative (F&A) Costs, are general and not attributable to a specific project.

may be treated as a direct cost if they are allowable. For example, Administrative and Clerical support could be a direct cost when it is directly related to the specific project, such as administrative assistance with tabulating survey results for the research.

Direct Costs (cont.)

The following are unacceptable practices:

- Comingling Charges: Inappropriately comingling charges against grants, for example, charging a grant that has funds for costs related to another grant that has no funds.

- Remaining Funds: Inappropriately charging the grant solely to spend remaining funds.

- "Parking" Charges: Inappropriately allocating charges among sponsored projects, i.e., "parking charges" – temporarily charging a cost to a grant that has funds while awaiting the award of a new grant.

- Misrepresentation: Misrepresenting costs or describing a cost as something other than what it is, e.g., describing office supplies as lab supplies.

- Transferring Overdrafts: Transferring overdrafts from one sponsored project to another.

Direct Costs (cont.)

The following are direct costs that are generally allowed. This is not an all-inclusive list.

Allowable direct costs include:

- Salary

- Fringe benefits

- Supplies and materials

- Equipment

- Travel

- Subaward costs

Direct Costs (cont.)

The following are direct costs that are generally unallowed. Again, this is not an all-inclusive list:

- Advertsing (only certain types allowed)

- Alcoholic beverages

- Entertainment

- Fundraising or lobbying costs

- Fine and penalties

- Memorabilia or promotional materials

- Relocation costs if employee resigns within 12 months

- Certain recruitment costs, such as color advertising

- Certain travel costs, such as first-class travel

- Cash donations to other parties, such as donations to other universities

- Interest payments

- Membership in civic, community, and social organizations or in dining and country clubs

- Goods or services for the personal use of employees, including automobiles

- Insurance against defects in UNH's materials or workmanship

Indirect Costs

Indirect costs, also known as overhead, or Facilities and Administrative (F&A) costs, are general and are not attributable to a specific project.

Examples of indirect costs include:

- Maintenance and operation of facilities

- General administrative costs, such as Finance & Administration, Human Resources, General Counsel

- General office supplies

- Utilities

Click here to review Uniform Guidance on indirect (F&A) costs.

UNH's F&A rate is negotiated with the Federal Government (Department of Health & Human Services [DHHS]). This rate is used to establish UNH's recovered indirect cost for each sponsored program. The current rate Agreement is available here.

Spending on an Award

Once a grant fund has been established, the PI will receive notification from UNH Research Administration. Spending may now begin to the award budget.

Spending on an Award (cont.)

Salary and Fringe Benefits: Key Personnel (PI and Faculty)

Most federal agencies regard research as a normal function of faculty members at institutions of higher education. Therefore, PIs should keep the following points in mind:

- Salary charged for Key Personnel on awards should be consistent with their level of commitment on the project and calculated based on their institutional base salary.

- The National Science Foundation (NSF) generally limits salary support for senior personnel to no more than two months in any one year.

- DHHS and the Department of Justice (DOJ) have salary caps that must be observed.

- Agency prior approval is required when the PI or Co-PIs reduce their level of commitment devoted to the project by 25% or more.

- Effort must be documented in accordance with UNH policy on Effort Reporting.

Click here for additional guidance on Key Personnel.

Spending on an Award (cont.)

Salary and Fringe Benefits: Administrative and Clerical Personnel

Ordinarily, administrative and clerical salaries are treated as indirect costs.

Administrative and clerical salaries may be directly charged to a grant only if the costs are integral to the project and are explicitly in the budget/budget justification or have sponsor approval.

Click here for additional guidance on Administrative and Clerical Personnel.

Spending on an Award (cont.)

Travel Related Costs

General guidelines:

- Travel costs must be specified, itemized and justified in the proposal.

- Travel costs are subject to UNH and sponsor policies.

- Travel costs must provide direct beneft to the award and do not include traveling for professional development.

- Travel documentation must provide sufficient clarity so that anyone reviewing the transaction can verify that it is allowable, allocable, and reasonable.

- Charges that are split between two or more projects must demonstrate how the trip specifically benefited each project respectively.

- Funds requested for field work, attendance at meetings and conferences and travel associated with the proposed project at the time of the proposal may be charged to the grant.

Spending on an Award (cont.)

Travel Related Costs (cont.)

General guidelines (cont.):

- Generally allowable costs include:

- Meals

- Transportation

- Hotel

- Registration and other items incidental to the trip

Spending on an Award (cont.)

Travel Related Costs (cont.)

The following list highlights some common sponsored travel restrictions. Some awards may:

- Prohibit foreign travel.

- Require pre-authorization by sponsor for each trip.

- Restrict the number of trips that can be taken.

- Restrict the number of travelers on an authorized trip.

- Allow attendance to a conference to present research, but not for the purpose of "staying current in the field."

- Limit travel to a specific destination or purpose.

- Specify maximum meal, mileage, or other cost rates.

Click here to view OMB Guidance on Travel (CFR 200.475).

Click here to view the UNH Travel Policy.

Spending on an Award (cont.)

Meeting and Conference Expenses

A conference is defined as a meeting, retreat, seminar, symposium, workshop or event whose primary purpose is the dissemination of technical information beyond the non-Federal

entity (e.g., University of New Hampshire) and is necessary and reasonable for successful performance under the Federal award.

In addition to involving non-UNH personnel, conferences usually:

- Include an agenda

- Are held during standard working hours, and

- Are clearly identified in the proposed scope of work, budget, and budget narrative approved by the sponsor, or otherwise approved in writing by the sponsor.

Cost of attending a conference and the associated incidentals, e.g., hotels and per diem meals (if not included with registration) are reimbursable.

Spending on an Award (cont.)

Meeting and Conference Expenses (cont.)

Conference hosts/sponsors must exercise discretion and judgment in ensuring that conference costs are appropriate, necessary and managed in a manner that

minimizes costs to the federal award:

- Conference costs are typically allowable. This includes costs of meals, transportation, rental of facilities, speakers' fees, and other reasonable items incidental

to such meetings or conferences. However, because meals/food are seldom allowable outside of conference/training grants,

they must specifically be addressed in the budget and budget narrative or otherwise approved in writing.

- Typically, unallowable costs include those for 1) meetings to discuss, debrief, or otherwise work during mealtimes, and 2) meals or coffee breaks for

intramural meetings of UNH employees or students.

Click here to view OMB Uniform Guidance on Conferences (CFR 200.432).

Spending on an Award (cont.)

Meeting and Conference Expenses (cont.)

General guidelines for meals and entertainment expenses:

- Allowable expenses related to travel include meals for the PI and others supported on the same grant.

- Guest meals, e.g., paying for a professional colleague's meals, are not allowed to be charged to the grant

- Alcoholic beverages are not allowable.

- Entertainment costs, e.g., tickets to a show or sporting event, are not allowed unless approved in the award.

Click here to view the UNH policy on Travel Meals.

Spending on an Award (cont.)

Equipment, Materials and Supplies: Equipment

- Equipment is capitalized (including the cumulative cost of fabricated equipment) if the purchase price is $5,000 or greater and has a useful life of one year or more.

- Equipment can be acquired with federal funds only if the purchase has been specifically approved in the award document or by prior approval in writing of the agency's grant or contract officer.

- Before purchasing equipment using federal funds, the PI is expected to check with UNH Fixed Asset Management for availability and suitability of existing equipment.

In addition, an inventory of scientific instrumentation (i.e., equipment at UNHD, UNHL and UNHM) is available via UNHCEMS.

- Special terms and conditions of the award should be adhered to and may require prior signatory approval from the sponsor.

Spending on an Award (cont.)

Equipment, Materials and Supplies: Equipment (cont.)

- General-purpose equipment (includes office equipment and furnishings, modular offices, telephone networks, information technology equipment and systems, air conditioning equipment,

reproduction and printing equipment and motor vehicles) generally is not allowable, unless the equipment will be used primarily or exclusively for the research project. Budget justification

should include detailed information linking the general-purpose equipment acquisition to the technical work of the project.

- Capital equipment is the property of UNH or a sponsor, not the faculty, department, or unit. Capital equipment should be safeguarded and used for UNH programs and purposes.

- On federal grants, equipment costs are excluded from the indirect (F&A) costs recovered.

- Fabricated equipment delivered to a sponsor or sponsor directed third parties are not considered capital equipment, are not coded as equipment and incur full F&A.

Click here to view the OMB Guidance on Equipment and Other Capital Expenditures (CFR 200.439).

Spending on an Award (cont.)

Equipment, Materials and Supplies: Materials and Supplies

- Consumables used in the performance of a project can be charged to a grant if they directly benefit the research, e.g., chemicals, reagents, and clinical supplies.

- Office supplies, such as binders, pens, paper, personal computers, flash drives, postage, etc., are usually not allowable as direct costs on grants, unless specifically permitted

by the sponsoring agency.

- When including animals, state the species and number of animals in the budget. Animal care costs (per diem) and shipping costs are included in the "Other Costs" category.

- In the specific case of computing devices, charging as direct costs is allowable for devices that are essential and allocable, but not solely dedicated, to the performance of a Federal award.

Click here to view the OMB Guidance on

Materials and Supplies (CFR 200.453).

Spending on an Award (cont.)

Subawards/Subrecipients and Contractors

General guidelines:

- The subaward process is used when UNH passes-through a portion of the sponsored award to another entity for the purpose of programmatic effort on the project.

All of the terms and conditions that are part of the prime award must be included in the subaward document. Acceptance of these terms by an authorized signatory of the receiving

entity is required. The entity receiving the funds is a subrecipient.

- A procurement process is used when UNH buys goods or services for the benefit of the project. In this instance, the activity is a procurement, and the entity receiving the funds is a contractor/vendor.

Spending on an Award (cont.)

Subawards/Subrecipients and Contractors (cont.)

Determining a Subaward: Does the entity receiving a portion of the funds:

- Have their programmatic involvement identified as a separate scope

of work, with separate budget and organization approval?

- Have their performance measured against whether the objectives of the project are met?

- Have responsibility for programmatic decision-making?

- Have responsibility for adherence to applicable program compliance requirements?

- Use the sponsored funds to carry out a program of their organization as compared to providing goods or services for a program at UNH?

Spending on an Award (cont.)

Subawards/Subrecipients and Contractors (cont.)

Determining a Subaward: Does the entity receiving a portion of the funds:

- Have responsibility for assisting in completion of a project deliverable and/or technical report?

- Have the right to publish project results or serve as a co-author?

- Have the option to develop patentable technology?

- Have responsibility for adherence to applicable program compliance requirements?

If answers to these questions are "Yes," this activity should be classified as a subaward.

Spending on an Award (cont.)

Subawards/Subrecipients and Contractors (cont.)

Determining a Procurement: Does/Is the vendor/entity receiving a portion of the funds:

- Provide the goods and services your project requires within their normal business operations?

- Provide similar goods or services to many different purchasers? (this includes fabrication of new goods, consultants, editors, etc.)

- Operate in a competitive environment? (a for-profit organization or an entity/ university providing a testing service)

- Not subject to terms and conditions/compliance of the sponsoring agency?

- Not involved in the programmatic work of the project, including project deliverable or technical report?

If answers to these questions are "Yes," this activity should be classified as a procurement from a vendor. Click here to review guidance on Subrecipient vs Contractor Agreement.

Spending on an Award (cont.)

Subawards/Subrecipients and Contractors (cont.)

When an award involves a subrecipient, the PI's responsibilities are:

- Monitoring the subrecipient's progress including the receipt and review of technical performance reports (or other deliverables) and the review of expenses versus the budget

- Ensuring the subrecipient's compliance with the Subaward Agreement terms

- Reviewing the subrecipient's invoices for cost allowability, reasonableness, and appropriateness

- Ensuring that committed cost-share has been provided, and

- Approving and certifying only correct and appropriate invoices

Click here to review UNH Guidance on Subrecipient Monitoring.

Procurement

General rules:

- UNH has procedures in place to protect against waste, fraud and abuse

- Procurement Standards in OMB Uniform Guidance apply to the procurement of goods and services purchased with federal funds

Key principles:

- All purchases using federal funds must be necessary for the performance or administration of the federal grant

- Avoid purchasing duplicative items

- Maintain oversight to ensure contractors perform in accordance with terms and conditions

- Maintain documentation to support procurement decisions

- Use small businesses, minority-owned firms and women's business enterprises whenever possible

Procurement (cont.)

There are five methods of procurement available:

- Micropurchases: up to $10,000. May be awarded without soliciting competitive quotations if the University considers the price to be reasonable.

- Small purchases: $10,001 to $35,000.

- Rate quotes must be obtained from a minimum of two qualified sources

- Quotes can be obtained from suppliers or from public websites and included as backup for purchases

- Large purchases: $35,001 to $250,000. Must go through a formal bid process.

Procurement (cont.)

There are five methods of procurement available (cont.):

- Strategic purchases: $250,001 and above.

- Must go through a formal bid process

- Proposals must be solicited from an adequate number of qualified sources

- There must be a written policy for conducting technical evaluations of reviewing proposals and selecting the recipient

- Most advantageous bid is awarded, price and other factors considered

Procurement (cont.)

There are five methods of procurement available (cont.):

- Sole source: Over $10,000. Must meet one of the following four requirements:

- The item is available from a single source

- Public exigency or emergency for the requirement will not permit a delay resulting from competitive solicitation

- The Federal awarding agency or pass-through entity expressly authorizes in response to a written request, or

- After solicitation of a number of sources, competition is determined inadequate; cost and price analysis must be completed by the PI

Procurement (cont.)

Property Management

Property management is a shared responsibility:

UNH is responsible for and has procedures in place to ensure that all capital equipment is properly:

Procurement (cont.)

Property Management (cont.)

Property management is a shared responsibility:

PIs are responsible for:

- Making sure that they have made a reasonable effort to ascertain whether like and acceptable surplus equipment is available at UNH

- Maintaining and tracking the equipment

Monitoring Budgets, Review & Reconciliation, & Effort Reporting

PIs are expected to monitor budgets as well as review and reconcile project transactions on a regular basis.

Monitoring Budgets

- It is not uncommon for PIs to determine that they must rebudget funds in order to complete their research.

- For research grants incorporating standard federal Research Terms and Conditions, many federal agencies have delegated authority to UNH. An outline of the requirements for rebudgeting

and other prior approvals for these federal sponsors can be found in this Research Terms and Conditions Prior Approvals Matrix.

- Federal cooperative agreements and contracts may contain terms requiring prior approval for rebudgeting. Individual awards should be reviewed for unusual terms. Industry, foundation and other non-federal sponsors have various policies for rebudgeting. Refer to the sponsor's award for specific guidance.

To learn more about the budget process, please refer to the UNH Sponsor Approved Budget Process.

Monitoring Budgets, Review & Reconciliation, & Effort Reporting (cont.)

Review and Reconciliation

The PI in partnership with BSC and/or center staff are responsible for reviewing and reconciling project transactions. It is recommended that this review occur monthly

(but no less frequently than quarterly) upon receipt of the PI monthly reporting package. The PI will certify quarterly that project expenditures have been reviewed and reconciled.

The key components of reconciliation and review are:

- Confirming the expenditures belong on the account

- Confirming the amount charged is accurate

- Confirming the correct Expenditure Type was used

- Ensuring that expenses charged to the grant are authorized and properly documented

- Correcting any errors in a timely manner and in accordance with the Cost Transfer Policy

Monitoring Budgets, Review & Reconciliation, & Effort Reporting (cont.)

Effort Reporting and Certification

Effort must be reported and certified for all individuals who receive salary support from a sponsored project

or who expend committed effort on a sponsored project regardless of receiving salary support from the sponsor.

Effort on grants:

- The allocation of actual commitment to the grant is defined as a percentage of total university effort (TUE). For example, a 12-month appointment at 10% effort would equal 1.2 calendar months.

- The allocation percentage reflects an individual's activity regardless of where the salary is charged.

Monitoring Budgets, Review & Reconciliation, & Effort Reporting (cont.)

Effort Reporting and Certification (cont.)

It is the PI's responsibility to be aware of committed Effort for himself/herself and all project staff, and to promptly communicate via a written work

plan with his/her UNH BSC to assign salary charges to the award and adjust charges to other UNH accounts as appropriate.

Effort reporting is UNH's means of providing assurance to sponsors that:

- Salaries charged to sponsored projects are reasonable in relation to the work performed

- Faculty and staff have met their commitments to sponsored projects

- Effort certification occurs annually for faculty and PAT staff

- Effort certification for operating staff and part-time staff effort occurs on a bi-weekly basis

See Effort Reporting and Certification for more information.

Grant Closeout

Closeout Process

Closeout officially ends the award relationship; the closeout process is complete when the awarding agency has received all required reports.

This includes final financial, progress or technical, invention, project outcomes and equipment reports.

Grant Closeout (cont.)

Closeout Checklist

The following checklist should be used at the end of each award:

- Confirm salary amounts are correct, close payroll encumbrances, and move personnel to new account

- Collect, review and pay all final invoices (purchase orders, procurement card purchases, travel reimbursements)

- Ensure subrecipients submit their invoices typically within 60 days after the subaward end date

- Verify that all expenditures are allowable, allocable, reasonable and consistent with the terms of the agreement

- Ensure unused supplies inventory is less than $5,000

- Close all non-HR encumbrances Provide employees who may terminate due to this account's expiration written notice within 30 days (operating staff), and 90 days (PAT staff)

- Review and finalize committed cost sharing

- Provide service centers with new fund for recurring charges

- Submit all required reports within 90 days of close

Grant Closeout (cont.)

Record Retention

In accordance with Uniform Guidance 200.333, "Financial records, supporting documents, statistical records, and all other non-Federal entity records pertinent to a Federal award must be retained for a period of three years

from the date of submission of the final expenditure report or, for Federal awards that are renewed quarterly or annually, from the date of the submission of the quarterly or

annual financial report, respectively, as reported to the Federal awarding agency or pass-through entity in the case of a subaward."

Grant Closeout (cont.)

Record Retention (cont.)

The only exceptions to these requirements are:

- If any litigation, claim, or audit is started before the expiration of the 3-year period, the records must be retained until all litigation, claims, or audit findings involving the records have been resolved and final action taken.

- If in writing (e.g., in the award terms) by the Federal awarding agency, cognizant agency for audit, oversight agency for audit, cognizant agency for indirect costs or pass-through entity to extend the retention period.

- Records for real property and equipment acquired with Federal funds must be retained for 3 years after final disposition.

Training Summary

- Fiscal management of awards is a joint responsibility assumed by UNH as the grantee, the PIs, as well as others including SPA, RIS and the BSCs.

- Fiscal management oversight requires understanding and applying principles, policies and regulations encompassing several areas, including:

- Personnel

- Allowable Costs

- Cost Sharing

- Underrecovery of F&A

- Cost Transfers

- Audits

Training Summary (cont.)

- When charging to an award, costs must be:

- Allocable

- Allowable

- Necessary and Reasonable, AND

- Treated consistently and conform to the Terms and Conditions of the award

- UNH is responsible for and has procedures to make sure that all capital equipment is properly acquired, classified, safeguarded, depreciated, disposed, scrapped or sold.

- Expenses charged to the grant must be current and should be reviewed and reconciled each month by SPA-STAR and the PI.

Training Summary (cont.)

- Effort that has actually been completed must be certified as a condition of the award.

- Closeout officially ends the award relationship; the closeout process is complete when the awarding agency has received all required reports.

Here are some cases that illustrate abuses of the concepts in this module:

Congratulations

Once you have finished all the review questions click "Certify Completion'.